Belgium's high inflation rates are now a thing of the past, and 2024 was a more typical year. Home purchases of fresh vegetables increased last year. Among vegetables, led by tomatoes, all types saw growth except lettuce and chicory. Fresh fruit purchases experienced a slight decline in 2024. Bananas remained the most popular fruit, followed by apples, according to VLAM.

Regarding fresh vegetables and fruit purchase channels, there were few changes in 2024. DIS 1 remained a strong market leader, holding more than half of fresh fruit and vegetable sales. Hard discount chains strengthened their share, while the short chain, which lost ground in 2023, managed to recover. Out-of-home consumption saw an increase in visits but a decline in sales last year. However, fresh fruits and vegetables remain primarily consumed at home. These insights are based on consumer surveys from the YouGov panel of 6,000 Belgian households and the iVox/VLAM consumption tracker of 7,300 Belgians.

A more typical 2024: High inflation declines

Food inflation continued to decline, reaching 1.8% last year. Total food and household spending rose by 3.5% in 2024 due to more frequent shopping (+1.3%), higher spending per visit (+0.9%), and an increase in the number of households (+1.3%). The number of shop visits, which had hit a low in 2020, returned to pre-pandemic levels of 195 per year, with 61 of these visits involving fresh vegetables.

In 2023, Belgian households managed high food inflation by reducing basket sizes (volume per trip) and opting for budget-friendly alternatives (downtrading). This was no longer the case in 2024. The growth of private labels and hard discount (Aldi & Lidl) stalled, while A-brands regained some ground.

The fresh market remained stable in volume in 2024. Belgians spent €9.8 billion on fresh food, a 4% increase from the previous year. Per capita volume remained unchanged compared to 2023. The largest declines were in natural fruit juices, fresh molluscs and crustaceans, fresh white flat cheese, fresh herbs, and potatoes. In contrast, eggs, cream, butter, fresh dairy desserts, yogurt, and plant-based meat and dairy alternatives saw the strongest growth.

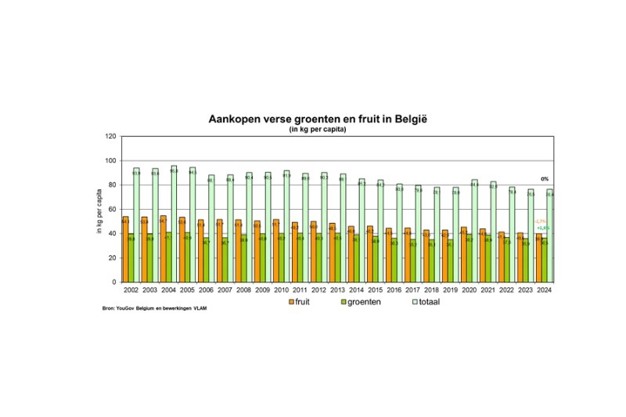

The average vegetable price rose from €3.36 to €3.48 per kg (+3%), while the volume of fresh vegetables purchased increased by 1.6%, resulting in a 5% rise in spending. Fresh fruit prices increased by 4.5% (from €3.31 to €3.46 per kg), but volume fell by 1.7%, leading to a 3% rise in fruit spending. Long-term trends show declining fresh fruit purchases, while fresh vegetable purchases remain stable.

Total fruit and vegetable purchases remained stable, while spending rose by 4%. In 2024, Belgians purchased an average of 36.5 kg of fresh vegetables and just under 40 kg of fresh fruit, spending €127 and €138, respectively. Together, this accounted for 76.4 kg and €265.

Tomato is the most purchased vegetable

80% of vegetables are bought in fresh form. So frozen vegetables and vegetables in preserves or jars make up only 18% of Belgians' vegetable consumption. The remaining 2% are ready-made meal salads. Within the fresh vegetables segment, pre-packed processed vegetables have a share of 11% in volume and 17% in spending.

Tomatoes remain the leader within the fresh vegetable range with 5.14 kg per capita closely followed by carrots with 5.02 kg per capita and in third place onions with 3.87 kg per capita. Cherry tomatoes continue to grow, accounting for 37% of the volume of tomatoes sold and 56% of tomato sales.

Within the vegetable top ten, led by the tomato, all greens were able to grow except lettuce (-1%) and chicory. Our national pride 'chicory', which was considerably more expensive last year (+26%), fell sharply in volume (-11%) but rose in turnover (+12%).

The strongest-growing vegetables in 2024 were green asparagus (+32%), Chinese cabbage (+21%), romaine lettuce (+11%), and turnips (+10%). Over the long term (2016-2024), sweet potatoes (+1355%), ground chicory (+378%), loose cherry tomatoes (+92%), Chinese cabbage (+76%), and romaine lettuce (+48%) saw notable growth.

Banana stable at 1

Bananas were the most purchased fruit in 2024, with 8.09 kg per capita. Apples followed at 6.67 kg, though sales fell by 1%. Jonagold maintained a 40% share of the apple market. Grapes (+9%), nectarines (+5%), kiwis (+3%), and strawberries (+1%) all saw growth. Pear sales continued to decline (-11%), with Conference pears dominating (80% share).

Outside the top ten, avocados (+7%) and blueberries (+3%) performed well. Over the long term, home consumption of blueberries (+154%), avocados (+85%), watermelon (+53%), blackberries (+48%), raspberries (+42%), and mangoes (+36%) has grown significantly.

Stable distribution channels

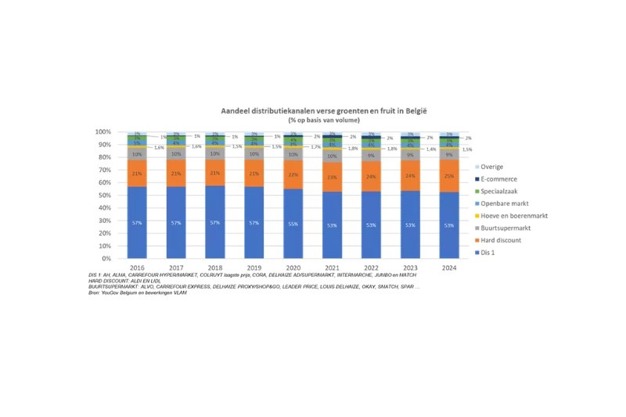

Fresh fruit and vegetable distribution remained stable in 2024. DIS 1 maintained a 53% market share, while hard discount rose from 24% to 25%. Neighborhood supermarkets held 9%, and public markets stabilized at 4%. Short chain sales, which lost ground in 2023, recovered to 1.5%. E-commerce, though still limited, doubled from 1% in 2016 to 2%.

Growth in out-of-home consumption, collected, and home-delivered meals

According to Foodservice Alliance, the number of visits in the foodservice market increased by 2% in 2024, but sales declined by 1% to €24.4 billion. Corporate, healthcare, and education catering, along with bars and 'on the go' options (such as petrol stations), performed well last year. In contrast, tourism, quick service restaurants, and bistros experienced a drop in turnover.

Home remains by far the most important place of consumption, but its significance is gradually declining in favor of out-of-home consumption and consumption of collected and home-delivered meals. According to the VLAM consumption tracker (survey by iVox of 7,300 Belgians), 72% of hot meals for Belgians aged 18 to 75 were self-prepared in 2024, down from 74% in 2014. Of these hot meals, 8% were collected or home-delivered, 8% were ready-to-eat meals (purchased in shops for reheating at home), and 12% were eaten away from home (in restaurants, at work, etc.).

Vegetable consumption mainly at home and with evening meals

In addition to data on home consumption, VLAM provides insights into the total consumption of fresh products among Belgians through the consumption tracker. This shows that, on an average day in 2024, 67% of Belgians ate vegetables. Vegetable consumption was primarily during evening meals (56%). Of all vegetable eating occasions in 2024, 76% occurred at home, 6% at family or friends, 8% at work or school, 2% while traveling, and another 8% at other locations, including catering establishments.

Daily consumption of fruit spread throughout the day

On an average day in 2024, 60% of Belgians consumed fruit. Fruit consumption was spread throughout the day, with the afternoon being the most popular time. Daily fruit consumption was higher in Flanders and Brussels, particularly among older adults and the higher educated. Of all fruit consumption moments in 2024, 74% occurred at home, 5% at family or friends, 15% at work or school, 3% while traveling, and 4% at other locations, including catering establishments. Notably, 9% of the fruit consumed was not purchased but was obtained from work, family and friends, or homegrown sources.

For more information:

Liliane Driesen

Driesen

VLAM

+32 02 552 80 32

[email protected]

www.vlam.be