Tiger Brands has announced the divestment of Langeberg & Ashton Foods (LAF) to a consortium of local fruit producers for R1 (approximately $0.05), citing challenges in maintaining its commercial viability. The transaction involves a newly formed company established by the consortium, which includes the Ashton Fruit Producers Co-operative. This co-operative comprises members from the Robertson, Ceres, Breede River, and Klein Karoo regions, bringing sector-specific expertise.

As part of the sale, Tiger Consumer Brands, a subsidiary, will invest R150 million (approximately $7.9 million) to create a community trust focused on socioeconomic development in the Langeberg area. This trust will acquire a 10% stake in LAF, with the remaining equity held by the consortium. In addition, Tiger Brands plans a R31 million (approximately $1.6 million) investment to upgrade an effluent plant, demonstrating its ongoing commitment to the region.

Tiger Brands emphasized that this transaction aligns with its strategy to focus on core markets, as LAF's product exports are primarily directed to Europe and Asia, outside its strategic priorities. LAF's seasonal operations require significant working capital, approximately R900 million (around $47.5 million) annually, and exiting this business is expected to enhance Tiger Brands' financial efficiency.

The transaction is subject to regulatory approval, with a condition that Tiger Consumer Brands and the purchasing consortium enter a contract manufacturing agreement to supply canned fruit under the KOO brand for Southern African markets.

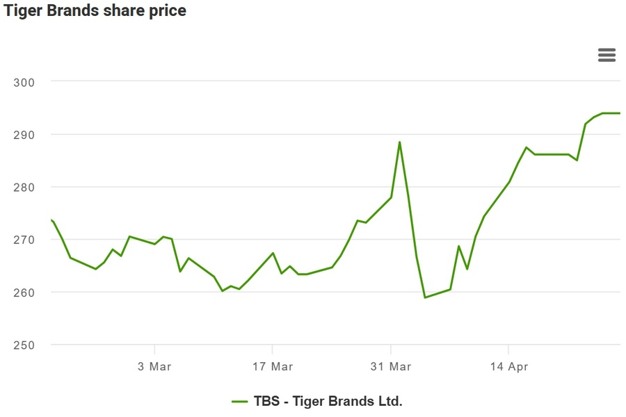

In a trading update, Tiger Brands projected a 15% to 25% increase in headline earnings per share for the six months ending 31 March 2025. The interim results are scheduled for release on 28 May 2025.

Source: Money Web